In India’s Electronics Manufacturing Services (EMS), where innovation sparks life into every electronic device we touch, two companies stand out: Kaynes Technology and Syrma SGS Technology. Both the companies operating in India’s electronics manufacturing sector have demonstrated impressive growth trajectories, but let’s take a closer look at the financials and future plans and conclude which company holds the better potential to grow.

Kaynes Technology and Syrma SGS Technology Financial Performance

Total Revenue growth

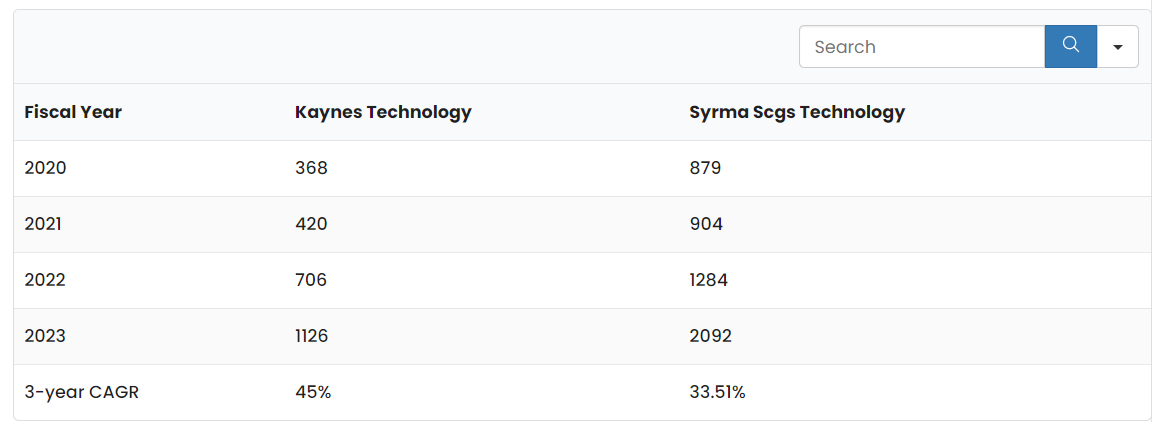

Kaynes and Syrma have grown their revenue significantly over recent years, while Syrma leads in the short term and Kaynes leads in the long term.

Syrma saw a revenue increase of 62% in FY23, while Kaynes exhibited a growth of 59%. However, Kaynes has had a consistent 45% growth in revenue since FY22, which outpaces Syrma’s 33% growth.

Net Profit Growth

When we talk about the net profit growth of both companies, Kaynes leads by a significant margin. Kaynes’ net profit increased by 116% from FY20 to FY23. The company has demonstrated its ability to extract substantial profit from its revenue growth. Syrma’s net profit is much slower in comparison to Kaynes, with a CAGR of just 10.57% over the same period.

Profit Margins

Net Profit Margins

Kaynes has outperformed in both operating and net profit margins, which indicates an efficient utilization of resources, which leads to increased profitability. On the other hand, Syrma has experienced a decline in operating profit margins due to a heavy rise in its operating expenses.

Return On Equity

Return on Capital Employed

Kaynes has seen a consistent improvement in its ROE (return on equity) and ROCE (return on capital employed) year on year; this reflects its ability to generate high returns for shareholders and efficient use of capital. In contrast, Syrma’s return ratio is facing a decline signal, resulting in a decrease in shareholder returns and an inefficient use of resources and capital.

Debt to Equity

Interest Coverage Ratio

Both companies have had a positive debt-to-equity ratio over the years, which indicates healthy financial management and less reliance on borrowed capital. However, Kaynes has successfully and significantly reduced its debt-to-equity ratio, which strengthens its financial position in comparison to Syrma.

Kaynes Technology and Syrma SGS Technology Future Plans

Kaynes Technology: aims to accelerate growth by significantly expanding its customer base and moving up the value chain while diversifying into new technology applications such as aerospace electronics and IoT solutions. The company has allocated a good amount of its investment towards this to enhance its existing facility and set up new manufacturing units.

Syrma SGS Technology: has aimed to capitalize on its strong order book and dive deep into the sector, leveraging its approval from Indian Railways, which they got recently. The company also has plans to expand its greenfield capacity to meet the growing demand and sustain its momentum in India’s EMS market.

Conclusion

both companies have demonstrated a significant and impressive growth trajectory in India’s EMS industry, but Kaynes emerges as a stronger contender due to its superior financial performance and ambitious expansion plans. With Kayne’s higher revenue and profit growth, improved profit margins, stronger return ratios, and good financial management, it outperforms the Syrma SGS technology.

Learn More About These Two Companies – Kaynes Technology, Syrma SGS Technology

Disclaimer: The views and recommendations above are those of individual analysts or brokerage companies and not TheStockMarketLive. We advise investors to check with certified experts before making any investment decisions. TheStockMarketLive. We advise investors to check with a certified expert before making any investment decisions.